By Leader Contributor Alexandra Jo, Culture and Content Manager at Parting Stone

Over the past year and a half, the deathcare profession has been at the frontlines of the COVID-19 pandemic. We have seen firsthand the enormous amount of excess death the pandemic has caused in the U.S.

According to the CDC, the age-adjusted death rate in America increased by 15.9% from 2019 to 2020. With so many of these deaths falling into the category of “excess death” or deaths that occur above and beyond expected amounts for a given time, this raises the question of if total death numbers will be impacted inversely in the years following the pandemic (i.e., Will America see a dip in overall death numbers post-COVID?). The results from extensive research on contemporary death rates pre-COVID, the impact of the pandemic, and what this means for the future of deathcare may surprise you.

Death Rates in America Pre-Pandemic

A recent article from The Leader outlined that mortality rates in middle-aged Americans have been consistently on the rise since about 2014, while life expectancy for Americans middle-aged and younger has persistently declined. These changes, the first consistent drop in life expectancy in America since the 1918 flu pandemic, have primarily been caused by the opioid crisis, lack of access to healthcare, lack of access to mental health support, and lack of living-wage paying jobs.

Research revealed that pre-COVID, the total number of deaths in America increased at an average rate of 1.68% (or, less than or equal to 2.5%) year over year from 2012 to 2019. Thus, even without the pandemic, American funeral professionals could have expected to see a rise in total deaths in 2020. With the pandemic beginning in March 2020 and continuing through the rest of the year, into 2021, and still today, the rise in total deaths jumped all the way to the 15.9% reported by the CDC, or even higher citings from other credible sources.

A Framework for Calculating Mortality Displacement

However, the question of if there were enough excess deaths in 2020 to cause a dip in overall deaths in years following the pandemic still stands. This phenomenon of a dip in deaths after a surge in premature death is also known as Mortality Displacement, or a period of excess deaths (i.e., more deaths than expected) is followed by a period of mortality deficit (i.e., fewer deaths than expected).

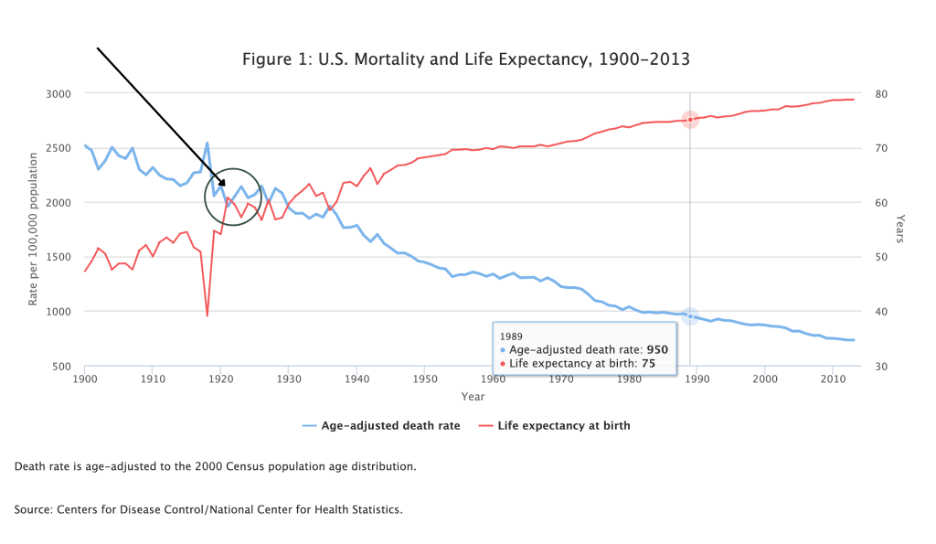

Looking at death rates and life expectancy in the U.S. across the last hundred or so years, we can use the 1918 flu pandemic as a model which shows us a dip in overall deaths in the U.S. in the years closely following the pandemic.

As shown in the graph above, the blue line, which represents death rates, decreases before 1918, spikes in that year, then takes a dip around 1920-21 and continues decreasing through 2010. The red line, representing life expectancy, rises before 1918, dips drastically (which means life expectancy shortens) during the pandemic, then continues going up after pandemic recovery. This data proves that before the flu pandemic, death rates were already steadily decreasing and lives were lengthening in the U.S. due to advances in medicine, social hygiene, and social behavioral changes. It makes sense that a surge in premature deaths would easily cause a larger dip in total deaths post-pandemic in a country already seeing sharply declining death rates.

Thus, with death rates due to factors outside of the COVID-19 pandemic rising so rapidly in pre-COVID-19 America, excess death rates in the pandemic would have to be gargantuan to interrupt that steady growth pattern. Exactly what deathcare professionals can expect in the next 10 years begs further examination.

COVID-19 Excess Death Numbers

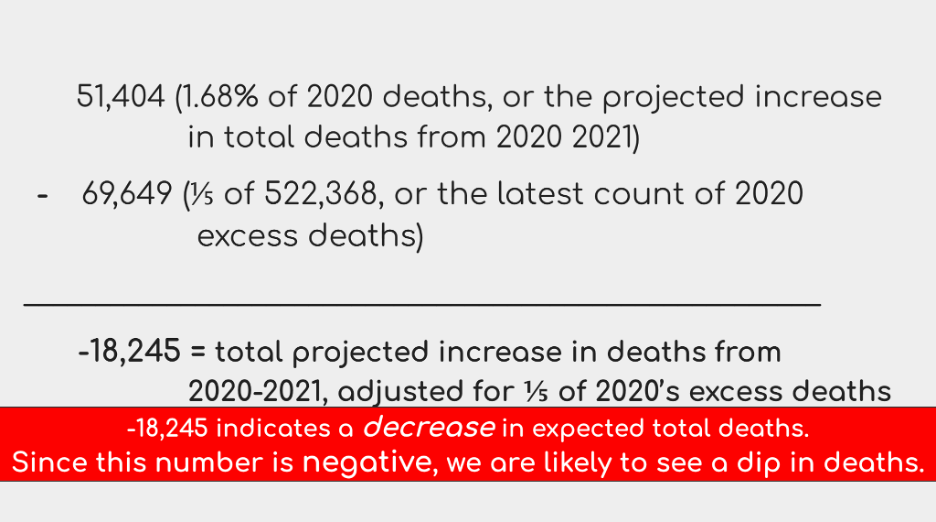

As of May 2021, the CDC’s official excess death count for 2020 was 299,000 with COVID-19 accounting for about two-thirds of those excess deaths. This initial count was only factoring in the months of March through October 2020. However, in the past month, the CDC has issued a new, more comprehensive excess death count for America in the full calendar year of 2020. The new total excess death count for 2020 is 522,328. This new count is large enough for calculations to predict a potential decline in deaths post-COVID, especially considering the fact that the pandemic has continued throughout 2021 and is not over as this year draws to a close. Until the pandemic is stalled, this means even more excess death in the short term, which eats into supply and demand for funeral businesses in the long term.

We see a projected decrease in total death numbers in America of -18,245. Since this number is in the negative, that signals a decrease in expected total deaths for the first time in almost a decade. However, this decrease is unlikely to begin in 2021, as the pandemic is ongoing, and excess deaths are still occurring and accruing. This math should be re-calculated when we finally see the pandemic slowed to a halt, and we have concrete total excess death numbers for the entire pandemic. The bottom line here is that the longer the pandemic goes, the bigger that potential mortality displacement dip in deaths will be in the near future.

What Does the Long-Term Future of Deathcare Hold in The Era Following Extreme Excess Death?

While many funeral professionals might look at excess deaths in America as being a boon for their businesses, this is a short-term only perspective. A recent article on the Funeral Director Daily blog outlines how sudden, drastic increases in case numbers could bring value to funeral homes, but only if other important factors are considered. The article touches on employee burnout and the potential for customer service to suffer with drastic increases:

“When a funeral home and/or cemetery owner chooses not to invest in their employees, their business can be jeopardized. When employees experience burnout due to being understaffed, ultimately customer service suffers, leading to average sales failing and negatively impacting their bottom line. Not only can high case counts and understaffing affect the operational side of the business, but it can also be a mirror to the risks a potential buyer will see.”

Additionally, taking the short-term view doesn’t solve the problem of what funeral businesses can do to sustain their businesses during the ever-more likely mortality displacement our country is likely to see post-COVID (whenever that is) and into the future beyond.

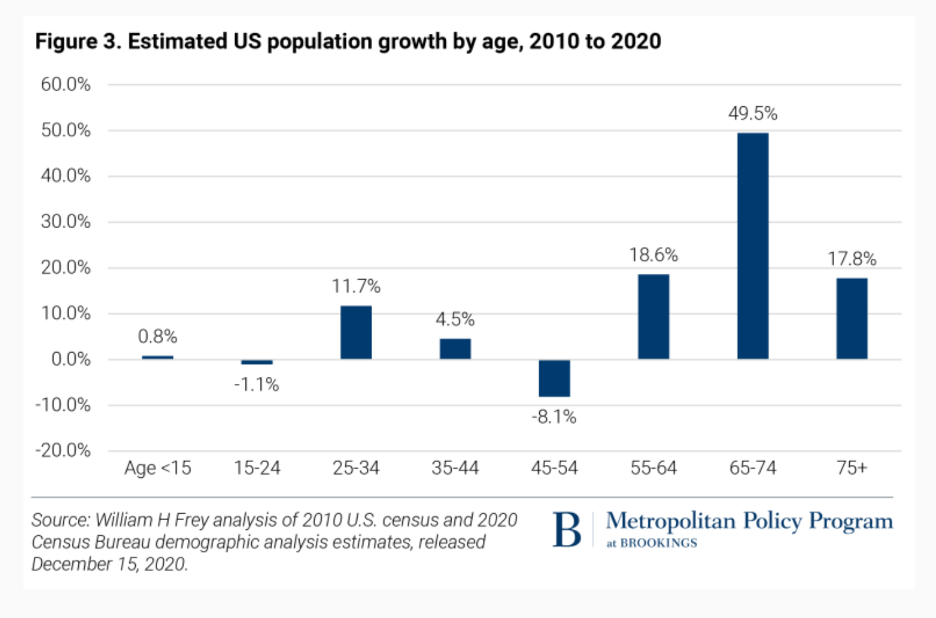

Younger generations like Gen Z and Gen Alpha are smaller than the Baby Boomers before them. As life expectancy decreases for larger populations (more deaths now) and smaller generations age into death over the next century, we are looking at fewer total deaths in America, simply due to generational supply and demand issues over the next hundred years.

Funeral professionals can begin solving the problem of how to sustain business long term by reframing how we generate revenue and learning to create immersive experiences for families instead of just selling products. We must also focus time and attention on customer service and meeting families where they are in their unique needs. Being prepared for smaller death numbers over the next century also includes building a balanced long-term business plan that cultivates a healthy company culture and mental health support for employees in order to avoid burnout and solve problems pertaining to employee retention in deathcare.

Even small adjustments can have a big impact. With cremation rates continuing to steadily rise in America, learning to build experiences around cremation and instating clear terminology that elevates perceived value in the services that your business provides will help increase revenue and turn cremation into a lucrative part of your business. These strategies will all go a long way to sustaining our businesses long term.

To learn more about these numbers and what deathcare can expect from pandemic excess death, listen to the Deathcare Decoded podcast Episode 32.